The Group’s defence segment saw a 36% jump in sales and a 20% rise in its operating result, reaching €464 million with an operating margin of 12.4%. CEO Armin Papperger stated, “Rheinmetall is successfully on its way to becoming a global defence champion. We are now also a serious partner for US companies.”

Despite political delays in contract awards following Germany’s 2025 elections, the company recorded a record order backlog of €63 billion as of 30 June. “We stand by our responsibility for our democracy and the independence of Europe, where we are contacted by many countries regarding new projects,” said Papperger.

Operating free cash flow fell to €-644 million, mainly due to investment in new facilities and inventory build-up tied to major orders. Rheinmetall confirmed its full-year 2025 forecast, citing continued strong demand, particularly in Europe, Germany, and Ukraine.

In its Vehicle Systems segment, Rheinmetall posted a 46% increase in sales to €1.9 billion, supported by deliveries to the German armed forces and the inclusion of US-based Loc Performance. The segment’s operating result rose from €119 million to €179 million.

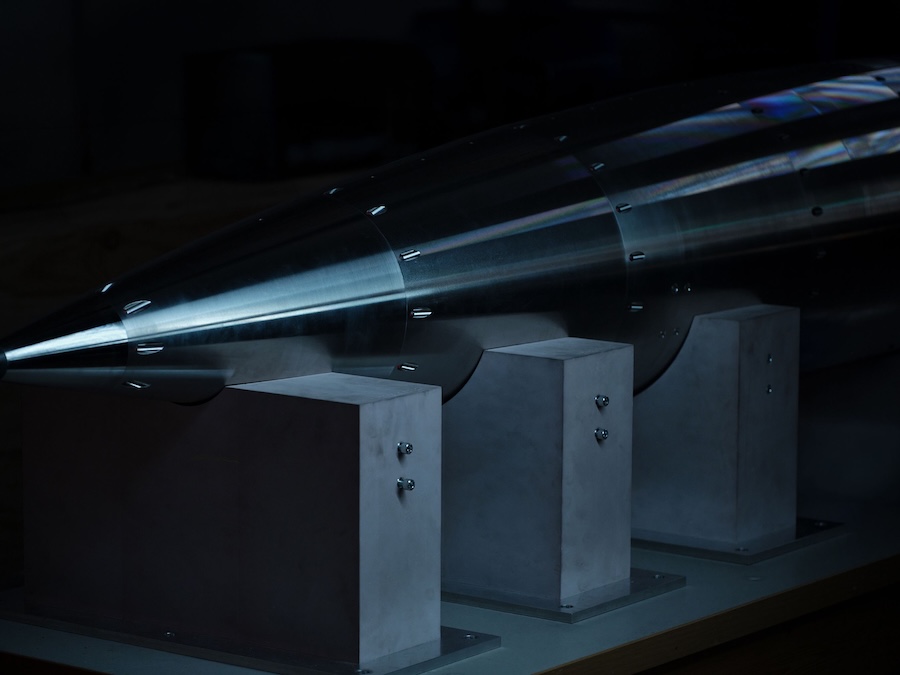

The Weapon and Ammunition division achieved record sales of €1.3 billion, driven by increased demand for tank, artillery and medium-calibre ammunition, notably from NATO and Ukraine. The division’s operating result rose by 36% to €280 million, and investments reached €188 million, including the new “Lower Saxony plant”.

Electronic Solutions reported a 46% rise in sales to €944 million, supported by major German contracts for the TaWAN communications system and IdZ-ES soldier equipment. Rheinmetall Nomination for the segment rose 231% to €9.98 billion, while backlog more than doubled to €16.9 billion.

Sales in the Power Systems division fell by 7% to €987 million due to persistent weakness in the automotive market. The operating result dropped by 58% to €24 million, as the company continues its strategic shift away from civil markets.

Looking ahead, Rheinmetall expects consolidated sales to grow by 25–30% in 2025, and forecasts an operating result margin of around 15.5%. “We are working hard to further increase sales significantly and are investing in many European countries to create new capacity,” said Papperger, highlighting new and expanded facilities across the continent.

Rheinmetall has indicated it may adjust its forecast later this year, depending on further geopolitical developments and the evolving requirements of its defence clients.