The new plan follows statements made earlier this year by Christian Democratic Union leader Friedrich Merz, who said Germany aims to build “the strongest conventional army in Europe,” pledging to provide it with “all the financial resources it needs.” Five months later, Chancellor Olaf Scholz’s government appears ready to match that ambition with concrete acquisitions and investment commitments.

The document sets out around 320 planned procurement projects for the period up to 2035, with 178 already linked to identified contractors. German industry dominates, securing about 160 projects worth €182 billion, as the federal government seeks to anchor the country’s defence revival in its domestic industrial base.

Rheinmetall AG emerges as the largest beneficiary, appearing in 53 procurement lines with potential orders exceeding €88 billion, including €32 billion in direct contracts and €56 billion for subsidiaries and joint ventures such as the Puma and Boxer fighting vehicle programmes. The Bundeswehr plans to acquire 687 Puma infantry fighting vehicles—662 in combat versions and 25 for driver training—by 2035.

The procurement list also includes 561 Skyranger 30 short-range air defence systems designed to counter drones and low-altitude threats, a programme fully led by Rheinmetall. Millions of grenades and rifle rounds are part of the planned orders, underscoring the scale of Germany’s rearmament effort.

Diehl Defence is the second-largest contractor, with 21 procurement lines worth €17.3 billion. Its IRIS-T missile family forms the backbone of Germany’s future layered air defence system, including 14 IRIS-T SLM units valued at €3.18 billion, 396 SLM missiles worth €694 million, and 300 LFK short-range missiles valued at €300 million. Together, these programmes total around €4.2 billion, making IRIS-T one of the Bundeswehr’s key future capabilities.

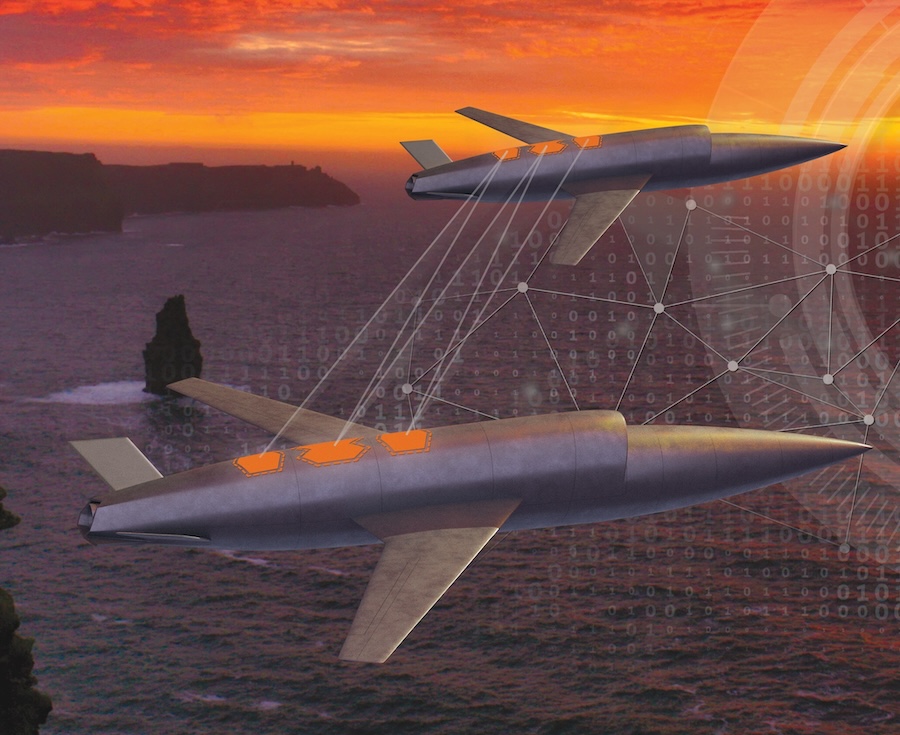

The Bundeswehr also intends to expand its fleet of unmanned systems. The plan includes new munitions for Israel’s Heron TP drones valued at about €100 million, 12 LUNA NG tactical drones for €1.6 billion, and four uMAWS maritime drones estimated at €675 million, covering spare parts, training and maintenance.

In addition to traditional domains, Germany’s new strategy places a major emphasis on space. Over €14 billion in satellite projects are planned, including new geostationary communication systems, upgraded ground control facilities and a low-Earth-orbit constellation worth €9.5 billion to secure resilient, jam-resistant connectivity for military operations. The initiative supports Defence Minister Boris Pistorius’ €35 billion “space security” strategy.

Despite the focus on domestic suppliers, several large-scale contracts will go to foreign firms, particularly in the United States. Germany plans to purchase 15 additional F-35A fighter jets from Lockheed Martin for about €2.5 billion under the U.S. Foreign Military Sales framework, supplementing 35 aircraft already on order. The move will maintain Germany’s role in NATO’s nuclear-sharing arrangements and strengthen transatlantic defence ties.

The Bundeswehr also aims to acquire 400 Tomahawk Block Vb cruise missiles worth around €1.15 billion, alongside three Lockheed Martin Typhon launcher systems valued at €220 million, extending Germany’s strike range to roughly 2,000 kilometres. The German Navy will meanwhile receive four additional Boeing P-8A Poseidon maritime patrol aircraft at an estimated cost of €1.8 billion.

Altogether, foreign-linked projects amount to around €14 billion—less than five percent of the total planned spending—but they encompass nearly all of Germany’s nuclear, long-range strike and strategic reconnaissance capabilities. In contrast, roughly half of the total investment will be channelled into domestic industry, with armoured vehicles, munitions and air defence systems forming the core of the Bundeswehr’s modernisation.

The timing of this procurement blueprint coincides with Berlin’s effort to exempt defence spending from Germany’s constitutional debt brake, allowing multi-year investments beyond the €100 billion special fund introduced by Chancellor Scholz in 2022. Once each project reaches maturity, it will be submitted for parliamentary approval, as all contracts exceeding €25 million require sign-off by the Bundestag’s budget committee.

The Politico report concludes that Germany’s rearmament drive, while economically focused on supporting national industry, places its most critical military functions—nuclear deterrence, long-range strikes and strategic surveillance—firmly within transatlantic frameworks. As Europe’s defence landscape continues to evolve, Berlin’s €377 billion plan underscores its intent to become the central pillar of NATO’s conventional strength on the continent.

Source: Politico.