The decline in earnings was primarily due to $1.6 billion in pre-tax losses on programmes and $169 million in additional charges, impacting earnings per share by $5.83. Free cash flow also turned negative at $(150) million, compared to $1.5 billion in the previous year, while cash from operations dropped to $201 million from $1.9 billion.

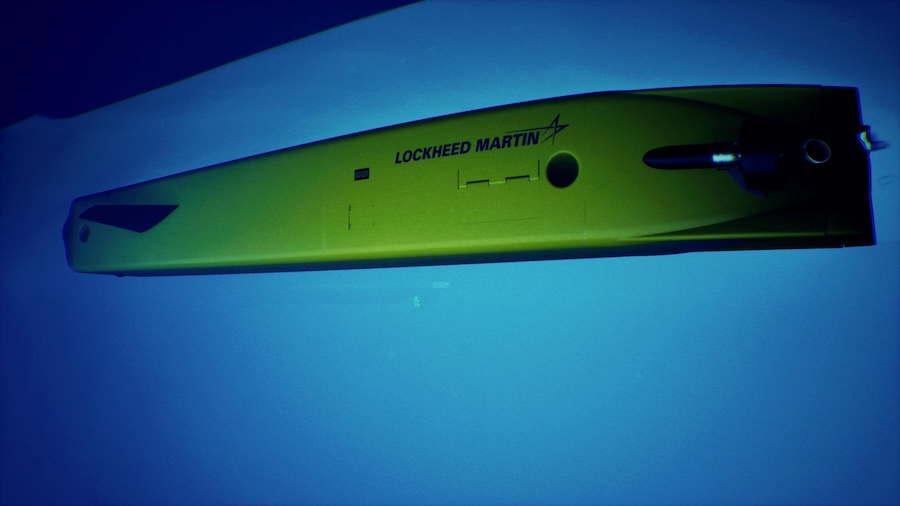

Despite these financial impacts, Chairman, President and CEO Jim Taiclet reaffirmed confidence in the company’s operational role and long-term prospects. “Over the course of the past few months, Lockheed Martin systems and platforms once again proved highly effective in combat operations and in deterring further aggression,” said Taiclet.

He highlighted growing demand for key programmes such as the F-35, with new orders from allied nations, and over $1 billion in recent missile-related contracts awarded by the U.S. Army. “Our U.S. and allied customers are asking us to elevate and accelerate many key programs,” Taiclet noted.

At the same time, Taiclet acknowledged that a programme review revealed developments requiring financial re-evaluation of several legacy projects. “As a result, we are taking a number of charges this quarter to address these newly identified risks,” he said.

Nonetheless, Lockheed Martin maintained its full-year 2025 guidance for sales, cash from operations, capital expenditure, free cash flow, and share repurchases. The company also returned $1.3 billion to shareholders during the quarter through dividends and buybacks.

Taiclet stressed the company’s ongoing commitment to investment and innovation, citing $800 million in infrastructure and technology funding during the quarter. “Our relentless focus on operational performance combined with our disciplined capital allocation strategy will enable us to deliver value to our shareholders, while providing the advanced solutions that America and its allies need,” he said.

Source: Lockheed Martin (press release).