Cash from operations climbed to $3.7 billion, compared to $2.4 billion in the third quarter of 2024, while free cash flow rose to $3.3 billion from $2.1 billion. The company returned $1.8 billion to shareholders through dividends and share repurchases.

Lockheed Martin increased its share repurchase authorisation by $2 billion, bringing total authorisation to $9 billion. The quarterly dividend was also raised by 5% to $3.45 per share, marking the company’s 23rd consecutive year of dividend increases.

Chairman, President, and CEO Jim Taiclet said: “Based on the effectiveness and reliability of our products and systems, strong demand from Lockheed Martin’s customers—both in the United States and among our allies—continues.” He added, “As a result of this unprecedented demand, we are increasing production capacity significantly across a wide range of our lines of business.”

The company’s backlog reached a record $179 billion, representing more than two and a half years of sales. “Our record $179 billion backlog—more than two and a half years of sales—underscores the trust our customers place in us and underpins our company’s long‑term growth prospects,” said Taiclet.

Lockheed Martin highlighted major contract awards for the CH‑53K and PAC‑3 MSE programmes, the largest ever for its Rotary and Mission Systems and Missiles and Fire Control segments. Contracts for F‑35 production Lots 18 and 19 were also finalised early in the fourth quarter, with a record 143 F‑35 Lightning II jets delivered by the end of Q3.

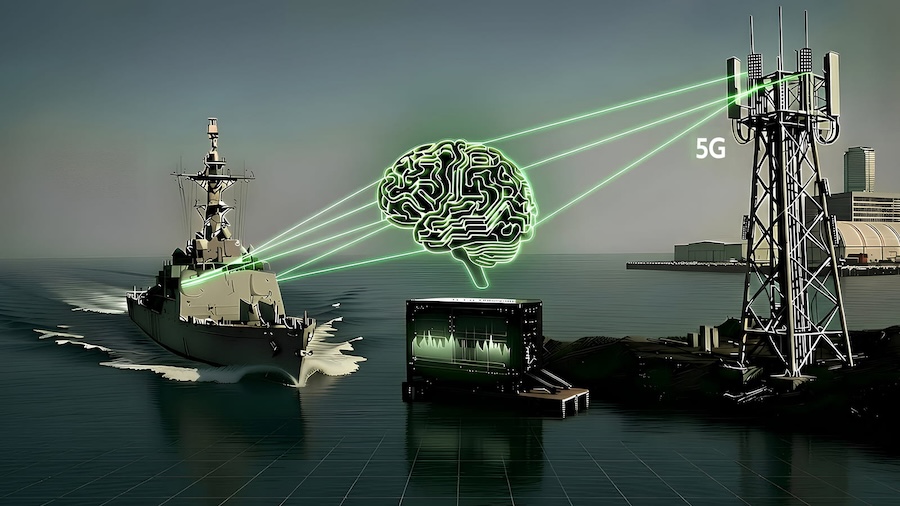

Looking forward, the company is investing in digital technologies and production capacity to meet the top defence priorities of the US and its allies. Taiclet noted: “Lockheed Martin is the capable leader and integrator across industry for these types of initiatives.”

He concluded, “Our disciplined capital deployment continues to provide robust, reliable rewards for our shareholders, highlighted by 23 consecutive years of dividend increases. Together, these results reflect a company built for performance today and poised for growth tomorrow.”