CEO Dr. Alexander Sagel said: “Given the geopolitical situation, we see it as our responsibility at RENK to make a significant contribution to a safe and sustainable future. The share of our defense business in the company’s total revenue will increase accordingly to around 90 percent by 2030.” He added: “The super cycle in the defense sector and the resulting profitable growth are not only reinforcing our market position, but also creating the basis for targeted expansion of our product portfolio beyond 2030.”

RENK highlighted an order backlog of €6.4 billion and rising demand across Europe, the USA and APAC as key drivers of its outlook. The group is expanding production in India, Eastern Europe and Italy to strengthen market presence, while RENK America Marine & Industry, formerly Cincinnati Gearing Systems, is progressing through its integration in the US marine sector.

Further targeted acquisitions in the defence sector are planned, building on the recent CGS purchase. RENK stated that its aftermarket and service business will benefit from increased localisation of maintenance activities, with Eastern Europe identified as the initial focus.

The company outlined plans to prepare its portfolio for future battlefield needs through its NextGen Mobility agenda. This includes work on electrification, hybridisation and digitalisation, as well as new developments such as the modular HSWL 406 transmission and entry into lighter tracked vehicle and UGV markets through the HSWL 076.

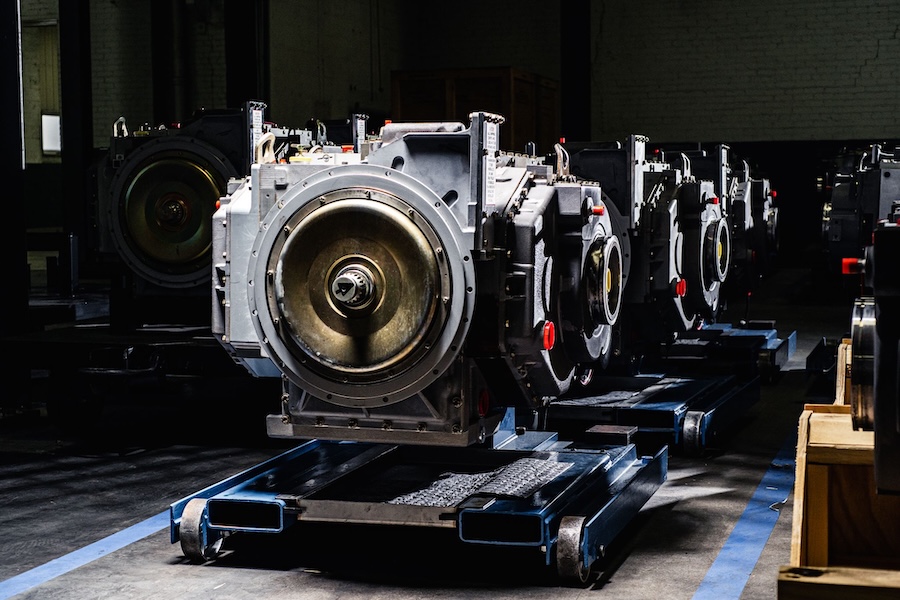

Operational excellence was presented as essential for long term performance. COO Dr. Emmerich Schiller said: “The commissioning of our modular production concept in Augsburg in September 2025 laid the foundation for taking our operations to the next level.” He continued: “We are using the concept as a blueprint for the entire Group’s production network in order to increase our efficiency, operational excellence and margins.” RENK aims to raise output at its Augsburg site from around 700 to more than 1,800 gear units annually.

The company also detailed a financial framework that combines organic expansion, selective M&A and measures to improve profits and capital productivity. CFO Anja Mänz-Siebje said: “One of our most important missions is to secure profitable growth for the long term. To this end, we have developed a clearly structured financial framework that provides us with orientation for the years ahead. At the same time, it ensures that our investors participate in this strategy in the medium and long term.”

RENK intends to keep average investment at around 3 percent of revenue and aims to achieve an adjusted EBIT margin of more than 20 percent by 2030.