Lukasz Prus, defence-industry.eu: The aerospace industry has a huge impact on the economy. Therefore, at the outset, I would like to ask: how big is the German aerospace industry today? How many companies today are actively operating in this industry and how many employees do they hire? How important is this industry for the entire German economy?

Philip von der Schulenburg, Head of Defence and Security, German Aerospace Industries Association (BDLI): The German Aerospace Industries Association represents about 250 companies, comprising a highly skilled workforce of over 100,000 employees and achieving an annual turnover of 31.4 billion euros (2021). As one of the leading high-tech sectors, the German aerospace industry is not just the engine of the economy, but also a major driver of innovation. The industry combines nearly all of the strategically important 21st century technologies. Many other industries directly benefit from aerospace, such as manufacturing, aviation, IT, communications, tourism and the export industries.

German defence and aerospace companies have a very rich history of participation in international programmes relating to the Tornado and Eurofighter aircraft. Historically, how do you assess the importance of these programmes for the development of German companies? To what extent are they able to engage in similar programmes?

German aerospace industry is inherently tied to industrial cooperation. From the early 1960s, the branch was strategically set up to be able to cooperate with international partners, swiftly developing a strong focus on European collaboration. Tornado and Eurofighter are the major cornerstones of this process, accompanied by more recent projects in the transport- and rotorcraft domain (A400M, NH90, Tiger). German aerospace industry – from OEMs to SMEs – is predominantly engaged in these multinational programmes, contributing a fast and highly competitive portfolio of technology and services. Keeping this edge and level of performance is key for the industry, to obtain its status as an attractive partner and driving force of European cooperation.

German companies are actively participating in a number of industrial cooperation projects within the framework of European Union programmes, such as PESCO, EDIDP and EDF. Which of these projects are the most promising? What are the benefits for companies of participating in these projects? On a different note, what barriers to establishing cooperation with companies from other EU countries do German companies encounter most often?

German aerospace industry is actively and comprehensively engaged within PESCO, EDIDP, PADRE, EDF and will certainly keep doing so for future formats to come, as these programmes foster European collaboration while offering the possibility to pool industrial capabilities and increase the chances for market success. Nevertheless, intra-German coordination and communication have imposed certain challenges to forming new consortia, mostly coming down to the vast amount of industrial players, often spinning out of governmental oversight (e.g. German MOD) and systemic complications within German budgetary law. Most of these issues are currently being tackled, but there is still a healthy amount of work needing to be done.

Ripples of excitement ran through the defence and aerospace industries in Europe as news was announced of the launch of the German-French-Spanish FCAS/SCAF next-generation aircraft programme. How big German industry’s participation in this programme could be, and what are German companies hoping for today as a result of it? Finally, what impact can it have on the long-term health of German industry?

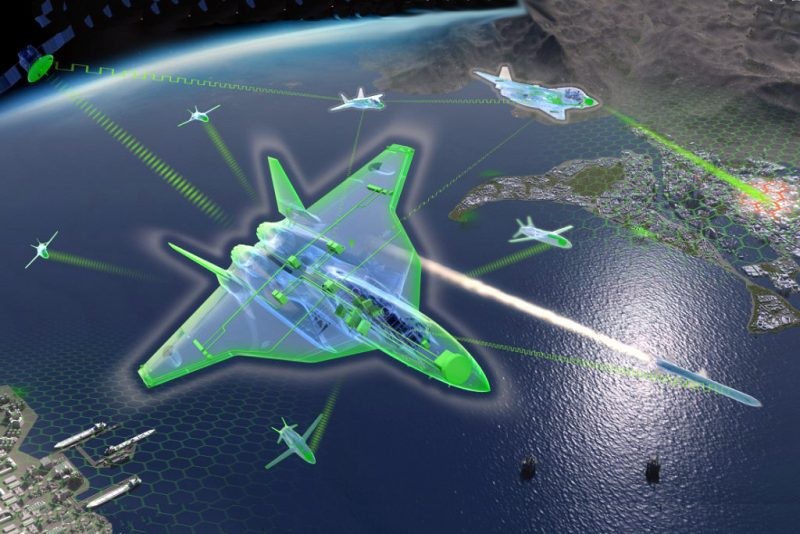

With its strong focus on technologies for manned, unmanned and connected systems, NGWS/FCAS will be the most important project for the German aerospace industry for the foreseeable future. German companies are contributing to all of the programme’s building blocks, called pillars. Based on equality and partnership they are eager to fully commit their resources and knowledge for the project to succeed. Because the current work’s nature is predominantly focused on overall system design and technological de-risking, the workshare of larger system companies and OEMs realistically outweighs the footprint of SMEs. All partners expect this balance to shift, as the programme progresses. This constellation highlights the importance of more mature projects for these SMEs to bring in and further develop their highly sophisticated and specific expertise, like the Eurofighter upgrade programme or the European MALE RPAS.

German companies will be a big part of the European MALE RPAS programme. What is the programme all about? What is your assessment today of the potential of German companies to design and manufacture advanced combat and reconnaissance drones?

EuroMALE will provide Europe with an indigenous and sovereign capability to develop, produce, operate and upgrade cutting edge MALE-type drones, closing a long lasting and painful strategic and industrial gap. It is also expected to create substantial technological spill-over towards the overall ability to integrate unmanned systems into civil airspace, highlighting the programme’s long term industrial and technological importance.

Whereas for political reasons German aerospace industry was not yet engaged in the development and production of a truly European MALE type drone, its companies have developed a wide portfolio of sub-systems, components, service solutions and even unmanned aircraft themselves. This is also the reason, German industry has pursued a strong role in the “Remote Carrier” section of the NGWS/FCAS programme. In this regard, EuroMALE is a key part of the industrial, technological and military ecosystem, as the product itself, like the know-how gathered in its development, will become a part of NGWS/FCAS.