Cash from operations in the first quarter of 2025 was $1.4 billion, compared to $1.6 billion in the first quarter of 2024. Free cash flow stood at $955 million, down from $1.3 billion in the same period of the previous year.

Jim Taiclet, Lockheed Martin Chairman, President and CEO, said: “The momentum we created last year continued into the first quarter of 2025, with sales growing 4% year-over-year and free cash flow generation of $955 million.” He added: “We continued investing in the business with over $850 million of research and development and capital expenditures in the quarter, and returned $1.5 billion to shareholders through dividends and share repurchases.”

Mr Taiclet also stated: “These solid first quarter results reinforce confidence in our ability to achieve the full year 2025 financial guidance we laid out in January, demonstrating the resilience and adaptability of Lockheed Martin’s franchises amidst a highly dynamic geopolitical and technical environment.” He continued: “We are focused on operational excellence to drive the timely and efficient execution of our $173 billion backlog, which represents more than two years of sales.”

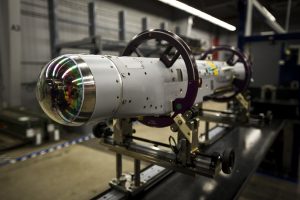

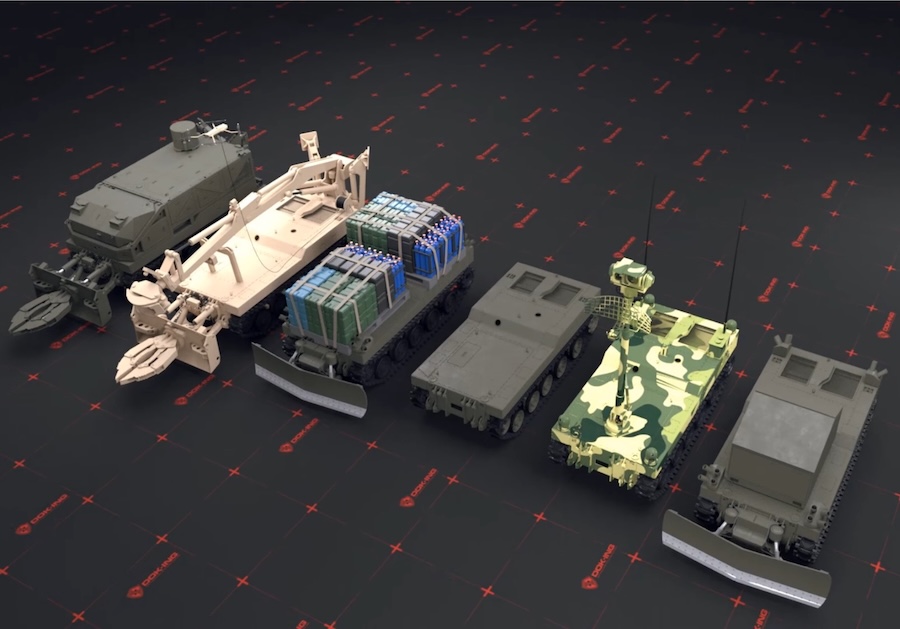

He further commented: “We remain committed to realizing our vision of digital and interoperable systems and are aligning our mission roadmaps to best support our customers’ rapidly evolving security needs, both domestic and global.” Mr Taiclet highlighted: “This focus, along with Lockheed Martin’s track record of innovation and performance, continues to result in new awards, including the recent missiles contracts for Precision Strike Missiles, THAAD and JASSM/LRASM, as well as the Trident II D5 Life Extension, comprising up to $10 billion of future work.”

Lockheed Martin operates through four business segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. The company provided a breakdown of financial performance across these divisions for the first quarter ended 30 March 2025.

Aeronautics’ sales increased by $212 million, or 3%, primarily driven by a $215 million increase from the F-35 program due to higher production volume. Operating profit for the segment rose by $41 million, or 6%, mainly due to favourable profit booking rate adjustments and increased volume.

Missiles and Fire Control (MFC) sales grew by $380 million, or 13%, primarily due to a $370 million increase in sales from tactical and strike missile programs, including the Joint Air-to-Surface Standoff Missile (JASSM) and Long Range Anti-Ship Missile (LRASM). MFC’s operating profit increased by $154 million, or 50%, driven by higher profit booking rate adjustments and production ramp-up.

Rotary and Mission Systems (RMS) sales rose by $240 million, or 6%, primarily due to higher volumes in integrated warfare systems and sensors (IWSS) and Sikorsky helicopter programs. RMS operating profit increased by $91 million, or 21%, reflecting improved profit booking rate adjustments, favourable contract mix, and higher production volume.

Space segment sales decreased by $64 million, or 2%, mainly due to lower volumes on national security space programs including the Next Generation Overhead Persistent Infrared (Next Gen OPIR) system. However, Space’s operating profit increased by $54 million, or 17%, due to favourable profit booking rate adjustments, despite lower equity earnings from United Launch Alliance (ULA).

Total equity losses from ULA represented approximately $(5) million, or (1)%, of Space’s operating profit during the quarter, compared to approximately $15 million, or 5%, in the first quarter of 2024. Lockheed Martin continues to monitor and manage its investments and performance across all segments in line with strategic and operational priorities.

Source: Lockheed Martin (press release).